hickey says he "could not be prouder of the coalition we built."

"For starters I want to communicate that our coalition does NOT disband today. We aim to work together in the days ahead to see healthier lending alternatives develop that are good for all.

"We believe in responsible lending and doing things that actually help people. You will see us around and hear our voices during future legislative sessions working on various measures yet to be passed, like trying to get programs for financial literacy more widely available in our state. And we anticipate the need to be vigilant to ensure the payday/title loan industry doesn’t try again to sneak something through the legislature.

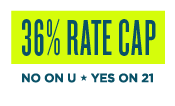

"I could not be more proud of the coalition we built. It’s actually remarkable and probably unprecedented for South Dakota to have the political left and right working closely together on a measure and to have the religious left and the religious right working together. Women and men, old and young, and rich and poor made up our supporters. They had a half a million in television ads. We had church ladies going out with sidewalk chalk. They had yard signs. Our people painted pumpkins with our message. It’s good South Dakota people of every flavor who are sick of the poverty industry taking advantage of our low wage state.

"This has been a pennies on the dollar grassroots South Dakota effort and it doesn’t get anymore bi-partisan than Steve Hildebrand and Steve Hickey working side by side on behalf of the poor and elderly in SD. Knowing that today in America we have reached perhaps the apex of hyper-partisanship, our efforts here of working together across the party lines is really a breath of fresh air and we believe this is the way forward in SD politics and that what we are modelling on this issue is something you’ll see more of in the future."