Why should we cap the interest rate on payday loans?

Payday lenders in South Dakota target working families and seniors. They charge an average interest rate of 574%.* Every year thousands of hard-working South Dakotans become trapped in a cycle of debt by payday, car title, and installment lenders.

These lenders offer a defective financial product intentionally designed to be a debt trap. The average payday loan borrower repays about $800 on a $300 loan because most borrowers simply cannot repay these short-term loans on time. As a result, borrowers are forced to take out another loan (and then another) just to pay the interest on their original loan. We believe families, seniors, and others who are economically vulnerable should be protected from greedy lenders charging 574% interest rate (or more).

We think it's wrong that these types of lenders have targeted those least able to pay their extremely high fees and interest: low-income families, seniors, veterans, and people living on fixed incomes. It is time to end the debt trap by capping the rate these lenders can charge. Will you join us?

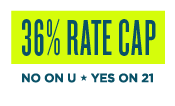

Stop predatory lending in South Dakota: on November 8, vote NO on Amendment U and YES on Initiated Measure 21

South Dakotans for Responsible Lending is a bipartisan coalition that seeks to cap payday, car title, and installment loans at an annual interest rate of 36%. That number was carefully chosen. In 2006 Congress determined that 36% was the maximum interest rate a person could dig out from on his or her own. As a result, Congress capped payday and title loans to active duty military personnel at 36%. The fear was that higher rates undermined our nation’s military readiness. A similar cap is already in place in 15 states and the District of Columbia. Other states, such as Vermont and Georgia, prohibit payday lending entirely. If these high interest rate loans are bad for our soldiers, and are prohibited or capped in many other states, then they are also bad for vulnerable South Dakota citizens. It is time to cap the rate!

Initiated Measure 21 will be on the ballot on November 8, 2016. Our campaign is working to make all South Dakotans aware they have the opportunity to cap the rate by voting YES on Initiated Measure 21. The payday loan industry has also put a Constitutional Amendment on the ballot that would prohibit rate caps. Thus, we also need South Dakotans to vote NO on Amendment U.

Attorney General's Statement & Official Text of Initiated Measure 21

Title:

An initiated measure to set maximum finance charge for certain licensed money lenders

Explanation:

The initiated measure prohibits certain State-licensed money lenders from making a loan that imposes total interest, fees and charges at an annual percentage rate greater than 36%. The measure also prohibits these money lenders from evading this rate limitation by indirect means. A violation of this measure is a misdemeanor crime. In addition, a loan made in violation of this measure is void, and any principal, fee, interest, or charge is uncollectible.

The measure's prohibitions apply to all money lenders licensed under South Dakota Codified Laws chapter 54-4. These licensed lenders make commercial and personal loans, including installment, automobile, short-term consumer, payday, and title loans. The measure does not apply to state and national banks, bank holding companies, other federally insured financial institutions, and state chartered trust companies. The measure also does not apply to businesses that provide financing for goods and services that they sell.

Frequently Asked Questions

Q: Why 36%?

It is understood that interest at or below 36% leave borrowers the ability to get out from under their debts. But rates more than 36% are what trap people in the outrageous debt cycles we are seeing. At the request of the Department of Defense, Congress limited the interest rate on loans to active-duty military members and their families to 36% APR (annual percentage rate) in the interest of military readiness. This law protects active duty, but not veterans. They need us.

Q: Why is the 18% limit (amendment u) called "fake"?

18% seems inviting, but read further: that limit does not apply to written agreements! Payday loans are written agreements. Every borrower must sign in writing. No lender is doing these loans on a handshake. Thus, the 18% will never apply to a single loan agreement. It is clearly designed to deceive the voters. If Amendment U were to pass in November, the State Constitution would say written loan agreements will have no limits on interest and fees! (The 36% rate cap would be illegal.)

Q: Where else could people go?

If payday lenders cannot figure out how to do business making 36% interest on loans to the poor, and decide to close shop, then there are alternatives. States without payday loan businesses say there are six healthier options:

- Talk to creditors and work out payment plans.

- Find ways to increase income. Add work hours, ask employer for an advance, or sell stuff on eBay. Even a pawn shop loan is better than a payday loan. The worst that can happen is the pawn shop keeps the item, and the borrower walks away, not trapped in a 574% interest payday loan that can lead to worse losses.

- Reduce expenses.

- Credit unions are an option. They have starter loans and credit cards with interest far below the rates of auto title loans (averaging over 300% APR) or payday loans (averaging 574% in South Dakota).

- Family and/or friends often help. It may be awkward and embarrassing, but it’s cheaper than a 574% loan taking a large chunk of your paycheck for months.

- Charity. Non-profit helping agencies, faith communities, and county or city aid programs may be able to help. Better to ask there before a payday loan makes things worse. Social service agencies help many people with certain expenses and credit counseling.

The short version is: Think about where you would go when you are swamped by debt, whether family, friends, church, county, etc.. But go there first. It will be a lot easier for anyone to help you before you are caught in overwhelming debt.

With or without a 36% rate cap, there are desperate people. But in states with the 36% cap, people don't get trapped in debt, and that's one less source of desperation.

Q: If other options exist, why do people take a payday loan or auto-title loan?

With all the advertising by predatory lenders and with loan centers on so many street corners, people are drawn in. Unsuspecting people go to payday lenders thinking they will get the help that is advertised. They are not looking for a debt trap.

Q: Can't people just read the interest rate on the paperwork?

Some see the high rates and walk out. Some can’t read. Some don't read the paperwork (like internet users often not reading “terms and conditions”). Some have not considered their other options. Some have limited mental ability or are emotionally stressed and trust the goodness of the lenders. Many assume they will be able to pay the loan back on payday and thus will be out only the $50 or $75 fee.

Then what happens?

Unfortunately, many obstacles happen: hours are cut, employer has a mix-up in payroll, car breaks down, utility gets shut off, child gets sick...this list goes on. Then borrowers are trapped because interest kicks in and they have even a bigger payment that is not always set on payday. Some are weekly. Then they will only take cash – no checks, money orders or credit cards. As these payments rise, people just can never get caught up because when they make payments, the late fees, etc do not stop.

Q: Won’t people just switch to online payday loans?

Studies show that restrictions on payday lending are not leading to more online borrowing. In states that restrict storefront payday lending, 95% of world-be borrowers elect not to use payday loans at all. Only 5% borrow online or elsewhere. [Pew Charitable Trust, “Who Borrows, Where They Borrow, and Why”]

Q: If these loan businesses leave the state, won’t that mean a loss of jobs?

1. South Dakota has very low unemployment. There are lots of jobs here, jobs that won’t cause the employee to lose sleep at night thinking about what they are doing to people.

2. When millions of dollars stop going from low-income people here to lenders in Georgia or Mexico, for example, that money will be spent locally. Spending locally is what creates jobs.

Q: Why did Google ban ads from payday lenders?

High-interest loans, those with more than 36% interest, are harmful. Google already had a list of things they will not advertise, because of the harm those items cause - things like pipe bombs, brass knuckles, recreational drugs, tobacco products.

The folks at Google had consulted with The Leadership Conference on Civil and Human Rights, which had released a report saying: "... payday and deposit advance loans often trap borrowers in hopeless cycles of debt, enriching lenders while driving borrowers into even more dire financial situations and leaving them unable to meet their basic needs such as food, health care, clothing, and education, putting them at increased risk for poverty and bankruptcy."

Q: If a 36% rate cap is so effective at curbing the harm of the short-term loans, why is the Consumer Financial Protection Bureau (CFPB) not recommending a 36% cap?

The Consumer Financial Protection Bureau (CFPB) does not have the authority to set rate caps for any type of product, including payday loans. This is why it is important for states, such as South Dakota, to continue to move to do so.

This particular prohibition was part of the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, which set up the CFPB, in 2010. (Oh, the power of payday lender lobbyists!)

Congress itself has the authority to set rate caps. It enacted the 36% rate cap for active-duty military and their families. States may set caps also. Fourteen states and DC have limits.